The Ultimate Guide To Top 30 Forex Brokers

Wiki Article

The 7-Minute Rule for Top 30 Forex Brokers

Table of ContentsThe 25-Second Trick For Top 30 Forex BrokersSome Ideas on Top 30 Forex Brokers You Should Know4 Easy Facts About Top 30 Forex Brokers ExplainedTop 30 Forex Brokers - The FactsThe Buzz on Top 30 Forex BrokersThe smart Trick of Top 30 Forex Brokers That Nobody is Talking AboutOur Top 30 Forex Brokers StatementsThe Basic Principles Of Top 30 Forex Brokers

Each bar graph stands for one day of trading and consists of the opening rate, highest possible rate, least expensive cost, and closing rate (OHLC) for a profession. A dash on the left stands for the day's opening rate, and a comparable one on the right stands for the closing price.Bar charts for currency trading help investors determine whether it is a customer's or vendor's market. The top section of a candle is used for the opening rate and highest price point of a money, while the lower section shows the closing price and lowest cost point.

Some Known Details About Top 30 Forex Brokers

The developments and forms in candlestick charts are used to determine market direction and activity.Financial institutions, brokers, and suppliers in the forex markets permit a high amount of take advantage of, implying investors can manage large placements with reasonably little cash. Take advantage of in the range of 50:1 prevails in forex, though also higher amounts of leverage are readily available from certain brokers. Nonetheless, take advantage of must be used carefully because several unskilled investors have endured significant losses utilizing even more take advantage of than was required or sensible.

The 10-Minute Rule for Top 30 Forex Brokers

A currency investor requires to have a big-picture understanding of the economies of the various countries and their interconnectedness to realize the principles that drive money values. The decentralized nature of foreign exchange markets means it is much less regulated than various other financial markets. The level and nature of regulation in forex markets depend on the trading jurisdiction.Foreign exchange markets are amongst the most fluid markets worldwide. They can be less unstable than various other markets, such as actual estate. The volatility of a certain money is a feature of multiple elements, such as the national politics and economics of its nation. Therefore, occasions like financial instability in the kind of a settlement default or imbalance in trading relationships with another money can cause significant volatility.

Top 30 Forex Brokers Fundamentals Explained

The Financial Conduct Authority (https://www.awwwards.com/top30forexbs/) (FCA) monitors and regulates forex professions in the United Kingdom. Money with high liquidity have an all set market and display smooth and foreseeable price activity in feedback to external occasions. The U.S. dollar is one of the most traded money on the planet. It is coupled up in six of the marketplace's 7 most liquid money sets.

The 6-Second Trick For Top 30 Forex Brokers

In today's details superhighway the Foreign exchange market is no longer entirely for the institutional investor. The last 10 years have seen a rise in non-institutional investors accessing the Forex market and the best site benefits it provides.

Top 30 Forex Brokers - An Overview

International exchange trading (forex trading) is an international market for getting and marketing currencies. At $6. 6 trillion, it is 25 times larger than all the world's stock exchange. Foreign exchange trading determines the currency exchange rate for all flexible-rate money. Therefore, prices change regularly for the money that Americans are most likely to use.

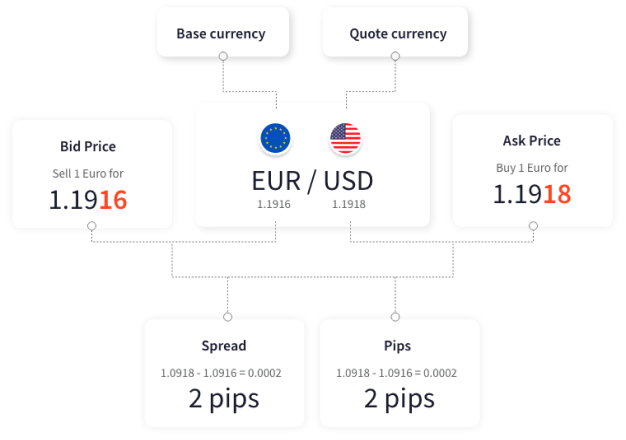

All money trades are performed in pairs. When you offer your money, you get the payment in a different currency. Every vacationer that has actually gotten international money has done foreign exchange trading. For instance, when you go on vacation to Europe, you trade bucks for euros at the going price. You sell U.S.

The Definitive Guide for Top 30 Forex Brokers

Place transactions resemble exchanging currency for a journey abroad. Spots are agreements in between the trader and the market maker, or dealer. The investor gets a certain currency at the buy rate from the market manufacturer and offers a various currency at the market price. The buy cost is rather greater than the asking price.This is the deal expense to the investor, which in turn is the revenue earned by the market manufacturer. You paid this spread without recognizing it when you exchanged your bucks for international currency. You would discover it if you made the deal, canceled your trip, and afterwards tried to trade the money back to bucks as soon as possible.

Some Of Top 30 Forex Brokers

You do this when you assume the money's value will certainly fall in the future. Businesses short a currency to shield themselves from risk. Yet shorting is very dangerous. If the money rises in value, you have to acquire it from the supplier at that price. It has the same benefits and drawbacks as short-selling stocks.Report this wiki page